Our Brisbane CBD Office

- Suite 400, Level 4/288 Edward St, Brisbane City QLD 4000

- (07) 3910 5470

When someone is injured in a motor vehicle accident, who to seek compensation from is typically a straightforward process through the Compulsory Third Party (CTP) insurance scheme. But what happens if the at-fault driver is unregistered, uninsured, or simply cannot be identified, such as in a hit-and-run accident? This is where the Nominal Defendant steps in to ensure that injured individuals still have access to fair compensation.

In Queensland, the Nominal Defendant plays a crucial role in upholding the rights of road users who would otherwise be left without recourse. This article explores the Nominal Defendant, how claims are made, and why legal representation is essential in navigating this complex area of personal injury law.

The Nominal Defendant is a statutory entity established under the Motor Accident Insurance Act 1994 (Qld) to provide compensation for people injured in accidents caused by unidentified or uninsured vehicles. Its primary function is to act as an insurer of last resort, ensuring that injured claimants are not left without financial support for medical expenses, lost income, and other damages.

In Queensland, the Nominal Defendant plays a crucial role in compensating individuals injured by unidentified or uninsured vehicles. According to the Motor Accident Insurance Commission’s (MAIC) 2021–2022 Annual Report, the Nominal Defendant paid a total of $32.38 million in compensation during that period. Approximately 43% of these claims involved uninsured motor vehicles, while the remaining 57% pertained to unidentified drivers. Geographically, about 50% of the claims originated from the Brisbane region, 29% from Southeast Queensland, and 16% from regional areas.

Hit-and-run accidents, where a driver involved in a crash leaves the scene without providing contact information or assistance, have been a persistent issue in road safety. In Queensland, while comprehensive data specifically tracking the trend of hit-and-run incidents over recent years is limited, the overall number of road fatalities has shown an increase. From 1 January to 17 November 2024, there were 265 fatalities resulting from crashes in Queensland, which is 21 more than the same period in the previous year, representing an 8.6% increase. The existence of the Nominal Defendant and the compensation laws means that those innocent victims are not without recourse.

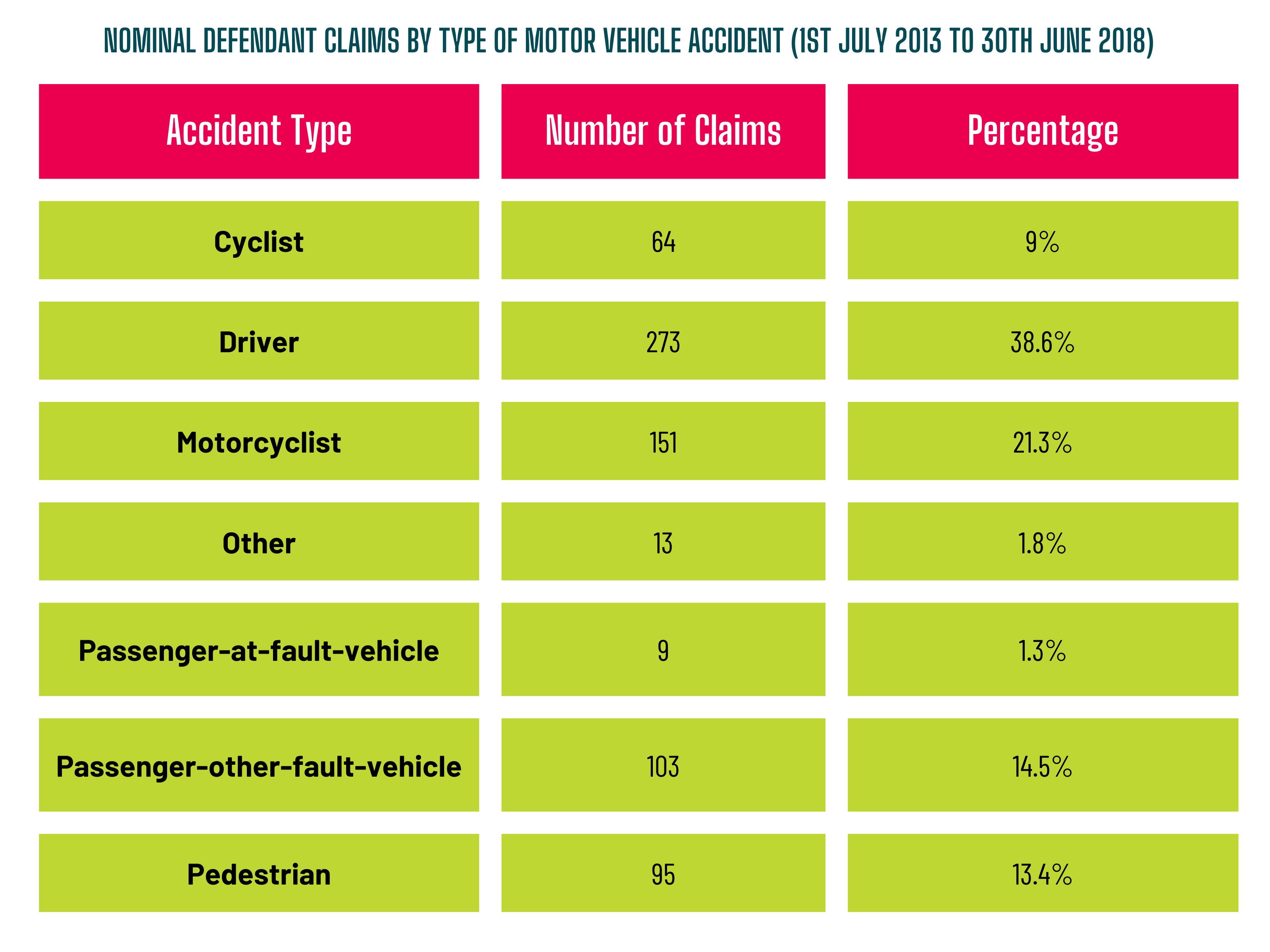

*Table of QLD Nominal Defendant Claims by Type of Motor Vehicle Accident

When a driver causes an accident while operating a stolen vehicle, the Compulsory Third Party (CTP) insurer covering that vehicle will be required to compensate injured third parties under Queensland’s CTP insurance scheme. However, the insurer retains recourse rights against the at-fault driver. This means the insurer can pursue the driver personally to recover the compensation paid to the injured parties. You will not be limited in your claim by the amount of assets that driver has, that is an issue for the CTP insurer.

Since the driver of a stolen vehicle is not an authorised user and is engaging in unlawful conduct, they are not covered by the vehicle’s CTP policy. If the insurer successfully recovers the payout, the at-fault driver may be held financially responsible, including being subject to legal proceedings, asset seizure, or wage garnishment to repay the compensation amount. This legal recourse helps ensure that negligent and unlawful drivers are held accountable for the injuries and damages they cause.

You may be eligible to lodge a claim against the Nominal Defendant in the following circumstances:

Filing a claim against the Nominal Defendant follows a structured process. However, it is often more complex than a standard CTP claim due to additional investigative requirements. Below are the key steps involved:

In Queensland, strict limitation periods apply to claims against the Nominal Defendant, making it crucial for injured individuals to act quickly. Under the Motor Accident Insurance Act 1994 (Qld), a claim MUST be lodged within three months of the accident if the at-fault vehicle is unidentified.

If a claim is not lodged within this period, the injured party must provide a reasonable excuse for the delay. A final nine-month limitation period applies, meaning that if the claim is not made within nine months of the accident and no reasonable excuse is provided, the injured person loses the right to claim altogether. Given these strict deadlines, it is essential to seek legal advice as soon as possible to ensure compliance with the time limits and protect the right to compensation.

Strict time limits apply to the nominal defendant because it is a body stepping in place of the actual insurer and in the case of a hit-and-run, the sooner matters are reported, the more likely the Nominal Defendant can gather evidence to support the claim and possibly find the offender.

Before lodging a claim, the injured person must make reasonable attempts to identify the responsible driver. This includes:

Failure to demonstrate reasonable efforts can lead to a claim being rejected.

In a Compulsory Third Party (CTP) claim, a claimant typically needs to prove that someone is at fault to successfully make a claim against the nominal defendant. This is because CTP insurance, which is required for motor vehicles, is designed to cover the costs of personal injury claims arising from road accidents. However, the process is dependent on the concept of liability, meaning that fault must be established to determine who should pay for the damages.

The nominal defendant is usually a party named in the claim when the at-fault driver is unidentified, uninsured, or cannot be located. In such cases, the claimant can pursue compensation through the CTP insurer of the nominal defendant. But to ensure fairness in the legal system, there is still a requirement that the claimant demonstrate fault in the accident. Without establishing fault, the purpose of CTP insurance, which is to provide compensation for those who have been wrongfully injured, cannot be fulfilled.

Establishing fault is necessary to avoid fraudulent claims. If claimants were able to file CTP claims without proving fault, it could lead to unjust compensation payouts, as people could try to claim for injuries resulting from accidents they were responsible for. Therefore, the law insists on proving fault, even when the at-fault driver is not identifiable, to ensure that the claimant’s injury was caused by the negligent or reckless actions of another party.

Moreover, CTP insurance is designed to cover the innocent victims of accidents. If a person is not at fault, their injuries would likely be compensable through the nominal defendant’s insurer. However, if fault cannot be established, the claim might not succeed, as it undermines the principle that CTP insurance should cover only the victims of others’ negligence. Hence, proving fault remains a fundamental aspect of having a successful CTP claim against the nominal defendant.

To maximize the likelihood of a successful claim, claimants must collect evidence, including:

Once a claim is lodged, the Nominal Defendant will investigate the accident circumstances, assess the claimant’s injuries, and determine the appropriate level of compensation. This may include:

Once liability is established, negotiations between the claimant (or their lawyer) and the Nominal Defendant take place. Many claims are resolved through settlement rather than proceeding to trial, but if an agreement cannot be reached, the matter may be taken to court.

Yes, the Nominal Defendant has the right to recover compensation from uninsured drivers when it pays out claims on behalf of an unregistered and uninsured vehicle. This means that if an at-fault driver was driving an uninsured vehicle and caused injury, the Nominal Defendant can seek to recover the payout amount from that individual.

This serves two key purposes:

If an uninsured driver cannot pay the amount owed, enforcement actions may be taken, including garnishing wages or seizing assets. The ability of the uninsured driver to pay the amount owed does not impact the amount of compensation the injured party is awarded.

One of the key principles of Queensland’s motor accident compensation system is that injured individuals are entitled to the same level of compensation, regardless of whether the at-fault vehicle is identified or not, or whether it was insured or uninsured. The purpose of the Nominal Defendant scheme is to ensure that victims of road accidents are not financially disadvantaged simply because the responsible driver is unknown or lacks proper insurance.

This means that if you are injured in a hit-and-run or by an uninsured driver, you have the same right to claim compensation for medical expenses, lost wages, and pain and suffering as you would if the at-fault driver had CTP insurance. The process may involve additional investigative steps, but the level of support and financial recovery remains consistent with claims against insured drivers.

Navigating a Nominal Defendant claim can be challenging due to the strict legal requirements and the burden of proving that an unknown or uninsured driver was at fault. Engaging an experienced personal injury lawyer in Brisbane can significantly improve the chances of a successful outcome.

Here’s how a lawyer can help:

Conclusion

The Nominal Defendant provides a vital safety net for individuals injured in accidents where the at-fault driver is uninsured or untraceable. However, due to the complexities involved in making a claim, engaging an experienced personal injury lawyer in Brisbane is highly recommended.

If you’ve been injured in a hit-and-run or by an uninsured driver, don’t navigate this process alone. Contact Trilby Misso today for expert legal advice and representation.

Kathryn is Trilby Misso’s Chief Executive Officer.

Meet KathrynUse this simple online tool and find out if you have a claim in less than thirty seconds. You can choose to remain anonymous.

Your next step is a small one. All you need to do is give us a call on 07 3910 5470 or complete this form here to arrange a quick chat.

During this initial conversation, we will:

We understand that taking legal action can be stressful, and we’ll do all we can to ease your concerns.

The chat can take place at our place, your place, or by phone. There is no cost, no pressure, and no obligation.

Call 07 3910 5470 or fill out this form, and we’ll get back to you within 2 hours (during business hours). We look forward to meeting you.

enquire now