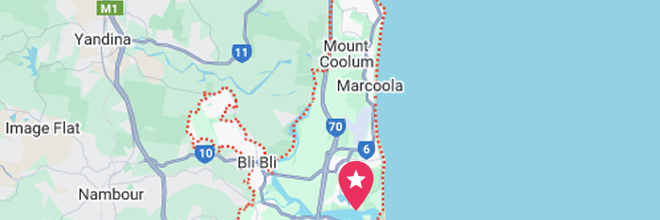

Our Brisbane CBD Office

- Suite 400, Level 4/288 Edward St, Brisbane City QLD 4000

- (07) 3910 5470

Total and Permanent Disability (TPD) claims offer crucial financial relief for individuals who are unable to work due to a severe injury or illness. In Brisbane, the TPD claim process can feel overwhelming, particularly when trying to navigate eligibility requirements, policy terms, and legal jargon. Understanding your rights is essential to ensure you’re fairly compensated and supported during what is often a difficult time.

A successful TPD claim can provide a lump sum payment that helps cover medical costs, living expenses, and other financial needs. However, many factors influence whether a claim is approved, including your insurance provider’s specific criteria, the extent of your disability, and whether you’ve met all necessary documentation requirements. To maximise your claim, it’s essential to understand the steps involved and to consider professional legal support.

This guide will walk Brisbane residents through everything they need to know about TPD claims—from eligibility and compensation to overcoming common challenges. If you’re considering a TPD claim or are struggling with an existing one, this overview will help clarify your rights and the support available to help you secure the compensation you deserve.

What is a TPD Claim and Who Qualifies in Brisbane?

A Total and Permanent Disability (TPD) claim is designed to support individuals who can no longer work due to a permanent disability, whether from an illness or a severe injury. In Brisbane, qualifying for a TPD claim involves meeting specific criteria set by your insurance provider or superannuation fund. Generally, TPD claims provide a one-off payment to help cover living costs, medical expenses, and any other financial needs that arise from a loss of earning capacity. Understanding what qualifies as a TPD can simplify the process and help you meet the necessary requirements to ensure a successful claim.

Key Criteria for a TPD Claim

To be eligible for a TPD claim, certain key conditions typically must be met:

Types of TPD Policies

In Australia, TPD policies can vary widely in their scope and conditions:

Ensuring that you meet these criteria and understanding your policy specifics are essential first steps in lodging a successful TPD claim in Brisbane.

The Role of Superannuation in TPD Claims: Understanding Your Benefits

When navigating Total and Permanent Disability (TPD) claims in Brisbane, it’s essential to understand how superannuation can play a crucial role in your eligibility and potential benefits. Many Australians hold TPD insurance through their superannuation fund, which can significantly impact the compensation available to you if you experience a permanent disability. This subheading will delve into the connection between superannuation and TPD claims, highlighting key aspects that claimants should be aware of.

Superannuation funds often include TPD insurance as part of their default coverage, making it essential for members to be aware of their entitlements. Understanding your superannuation policy can reveal important benefits you may not be fully utilising.

If you believe you qualify for a TPD claim through your superannuation fund, follow these steps to maximise your chances of a successful application:

Understanding the role of superannuation in TPD claims is vital for Brisbane residents seeking financial support during challenging times. By utilising the benefits of your superannuation fund, you can better secure the financial assistance you need.

Starting Your TPD Claim: Key Requirements and Essential Steps

Initiating a TPD claim in Brisbane requires careful attention to detail, as each step contributes to building a strong case. From gathering essential documentation to meeting your insurer’s criteria, following these steps can help improve your chances of a successful outcome.

Every TPD policy has unique definitions and requirements, so it’s crucial to review your policy terms before starting a claim. Some policies may define “disability” as the inability to work in any occupation, while others only require that you can’t work in your usual role. This initial review helps clarify your eligibility and guides you on what documentation will be needed.

Medical documentation is a cornerstone of any TPD claim. You’ll need to obtain written reports from your treating doctors or specialists that confirm the nature and extent of your disability. These reports should outline how your condition prevents you from working and why it is considered permanent. Regular appointments with your healthcare providers can be beneficial, as ongoing medical support strengthens your claim.

Once you have reviewed your policy and collected relevant medical evidence, the next step is to complete your insurer’s claim form. This form typically requires details about your injury or illness, employment history, and financial background. Be thorough and ensure all information is accurate, as inconsistencies can delay the processing time.

Navigating TPD claims can be complex, especially if you’re dealing with intricate policy language or have been denied in the past. Consulting with a TPD lawyer in Brisbane can help clarify the process, ensure compliance with all requirements, and improve your claim’s chances of success.

By following these steps carefully, you lay a strong foundation for your TPD claim, making it easier to secure the support you need.

Understanding Your Compensation Entitlements in a TPD Claim

The compensation available through a TPD claim can significantly impact your financial security, offering a lump sum to help cover a range of expenses when work is no longer an option. In Brisbane, TPD compensation varies depending on your insurance policy and the specific terms of your superannuation fund. Understanding what you’re entitled to can help you maximise your claim and manage your future finances effectively.

What Does TPD Compensation Cover?

The purpose of a TPD payout is to replace lost income and help you maintain a stable lifestyle. Generally, the compensation received can be used to cover:

Determining Your Entitlement Amount

The exact payout amount depends on several factors, including the specifics of your policy and the severity of your disability. Higher premiums often provide greater coverage, but this varies by insurer. Superannuation funds typically outline the amount available under a TPD claim, and a lawyer can help ensure you’re receiving the full entitlement.

Being well-informed about these entitlements is essential to maximising your claim and planning for your long-term financial wellbeing.

Overcoming Common Hurdles in Brisbane TPD Claims

While TPD claims can provide essential financial relief, the process is often complex, and claimants may encounter several challenges along the way. Understanding common hurdles can help you prepare and avoid potential setbacks, ensuring a smoother claims experience.

Common Challenges Faced by TPD Claimants

Many Brisbane claimants encounter issues due to:

Tips to Overcome These Challenges

To avoid these obstacles, it’s helpful to:

Being prepared for these challenges can make the TPD claims process in Brisbane more manageable and increase the likelihood of a favourable result.

How a TPD Lawyer Can Help You Maximise Your Claim

Navigating the complexities of a Total and Permanent Disability (TPD) claim can be daunting, particularly when dealing with the emotional and financial stress of a disability. Engaging a TPD lawyer in Brisbane can significantly enhance your chances of a successful claim, ensuring that you receive the compensation you deserve.

A TPD lawyer brings a wealth of knowledge and expertise that can streamline the claims process. Here are some key advantages:

Engaging a TPD lawyer not only boosts your claim’s chances of success but also provides peace of mind during a challenging time. They can handle the legal complexities, allowing you to focus on your recovery and well-being. By enlisting professional support, you’re taking a proactive step towards securing your financial future.

Australian Financial Complaints Authority (AFCA) – TPD Claims Dispute Resolution This page provides information on how to resolve disputes related to TPD claims if you’ve faced issues with your insurer. It offers guidance on the complaint process and additional resources. https://www.afca.org.au

MoneySmart – Making a TPD Insurance Claim MoneySmart offers a comprehensive guide to TPD claims, including information on eligibility, policy definitions, and steps to lodge a claim. It’s a valuable resource for understanding the basics of TPD insurance in Australia. https://moneysmart.gov.au

Kathryn is Trilby Misso’s Chief Executive Officer.

Meet KathrynUse this simple online tool and find out if you have a claim in less than thirty seconds. You can choose to remain anonymous.

Your next step is a small one. All you need to do is give us a call on 07 3910 5470 or complete this form here to arrange a quick chat.

During this initial conversation, we will:

We understand that taking legal action can be stressful, and we’ll do all we can to ease your concerns.

The chat can take place at our place, your place, or by phone. There is no cost, no pressure, and no obligation.

Call 07 3910 5470 or fill out this form, and we’ll get back to you within 2 hours (during business hours). We look forward to meeting you.

enquire now