Our Brisbane CBD Office

- Suite 400, Level 4/288 Edward St, Brisbane City QLD 4000

- (07) 3910 5470

Queensland has operated a fault-based common law Compulsory Third Party (CTP) Scheme since 1936. Despite insurers calling for reforms to the scheme, the QLD’s CTP scheme for insurance remains the best in Australia. You can make a claim for CTP insurance independently and communicate with the insurer directly; however, placing a claim can be a very complex process. You could save yourself, a lot of time, effort and stress by obtaining the help of a legal professional to act on your behalf. The Motor Accident Insurance Commission (MAIC) states that “you may choose to obtain legal advice at any stage of the claims process” and suggests that you discuss legal fees ‘before’ engaging a solicitor.

Compulsory Third Party (CTP) insurance covers the owner or driver of a vehicle against compensation claims in the event that they injure or kill someone in a road traffic accident. As per MAIC, individuals who can prove they were not at fault when injured during a motor vehicle accident are eligible to claim compensation. However, if those individuals can prove that they were partially responsible for the accident, they may still be entitled to a reduced claim. Even if the vehicle that caused the accident was uninsured or unregistered, a person might still be able to claim, but it is recommended that they seek professional legal advice.

CTP legislation in Queensland adheres to strict guidelines regarding timeframes for lodgement of notice of claim.

Notice of claim must be made:

Otherwise:

or

Claims are generally rejected if lodged outside the timeframes. Timely lodgement of a claim will ensure rapid access to treatment for injuries sustained and rehabilitation if required.

Claims are assessed on individual merit, but generally speaking, depends on the type and severity of the injury sustained, as well as personal circumstances. Compensation claims for motor vehicle accidents could include:

Additional claims may be applicable, but depend on personal circumstances, the percentage of impairment, and impact on the level of independence.

Relatives and dependents of the person who sustained fatal injury may also be eligible to make a claim for compensation covering:

If a CTP compensation claim is successful, and over $5000, the insurer may be required to repay any benefits or payments that the injured party received through Medicare, Centrelink or WorkCover.

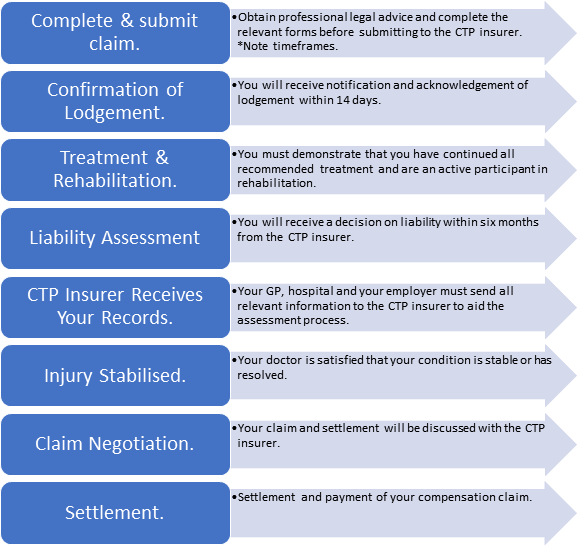

Making a CTP insurance claim is complicated and can be a cause of significant stress for the injured person and family members who may be responsible for making a claim at a very traumatic time. As per the ‘Eight Step CTP Claim Process’ below, there is a strict timeframe that applies to all claims and the process requires a multi-disciplinary approach to achieve a satisfactory outcome. It may seem relatively easy for the injured person or family members to lodge a claim, but in reality, the additional time and effort it takes to make the claim can add a lot of pressure to an already difficult situation.

A good lawyer will provide professional legal advice about your rights and will navigate the complexities of making a claim on your behalf. Your lawyer will understand the impact that a multi-trauma accident or, death due to a vehicle accident, can have on a family. Ultimately, a successful CTP claim will provide financial security for the injured party, peace of mind for family members and assurance that future financial and everyday needs are met.

Trilby Misso Lawyers seeks to alleviate your stress and will conduct all claims on a No Win, No Fee basis. We will lodge a claim under your compulsory third party (CTP) insurance policy to obtain compensation for your injuries as soon as possible. We are motorcycle accident lawyers, too. Strict timelines apply for all claims for compensation, so call Trilby Misso Lawyers for your free consultation today.

https://maic.qld.gov.au/scheme-knowledge-centre/ctp-scheme/.

Find Trilby Misso Lawyers on Facebook, Instagram and YouTube.

Kathryn is Trilby Misso’s Chief Executive Officer.

Meet KathrynUse this simple online tool and find out if you have a claim in less than thirty seconds. You can choose to remain anonymous.

Your next step is a small one. All you need to do is give us a call on 07 3910 5470 or complete this form here to arrange a quick chat.

During this initial conversation, we will:

We understand that taking legal action can be stressful, and we’ll do all we can to ease your concerns.

The chat can take place at our place, your place, or by phone. There is no cost, no pressure, and no obligation.

Call 07 3910 5470 or fill out this form, and we’ll get back to you within 2 hours (during business hours). We look forward to meeting you.

enquire now